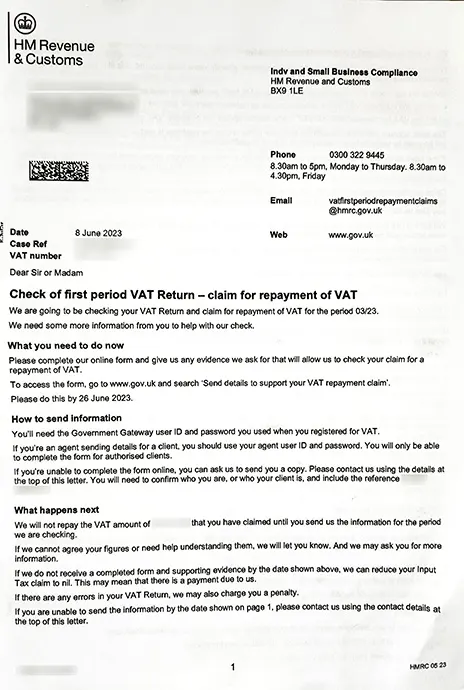

This is a verification notice from HMRC to check upon your VAT claims made in the returns and process them further. This requires you to submit more information to HMRC, supporting your refund claim with evidences.

Usually under cases where your inputs are higher than the output liability, a refund of excess taxes paid is due & such reclaim is called claim of repayment of VAT.

Some of the information which you might need to submit, differing through each case, could be -