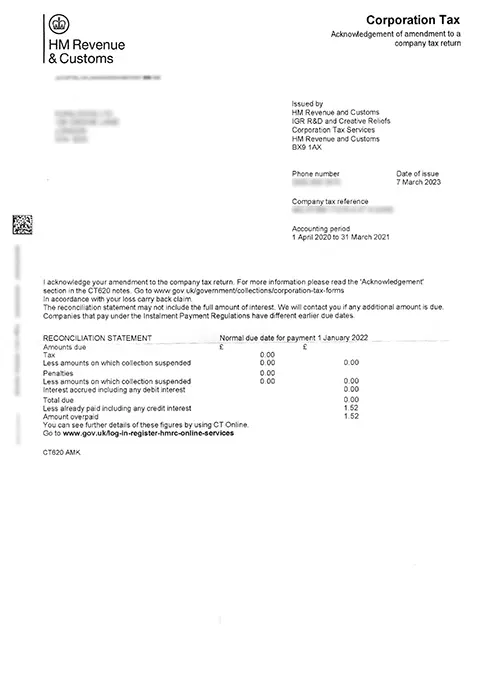

This is an acknowledgement of an amended tax return submitted for the company with HMRC by you or your accountant.

In case where any changes are made to the original tax return submitted with HMRC, an amended return is submitted to make all sorts of changes therein. This could be because of earlier omissions, mistakes or any fresh claims in respect of previous years which necessitated correction to your previous submissions.

No such action is required from your end on such notices, except for checking the calculations mentioned in the letter. In case you want to appeal it, you'll have to submit another amended return to HMRC. Where you are not aware about such an amendment, get in touch with your accountant to understand the course of action taken.

You can make changes to the corporation tax return of your company upto 12 months after the tax return filing deadline. This can be done either online or by sending a paper return to HMRC. Suppose you need to make changes in the return for the year ending on 30th November 2020, then deadline for filing the return will be 30th November 2021. Thus amendments, if any, need to be made upto 30th November 2022.