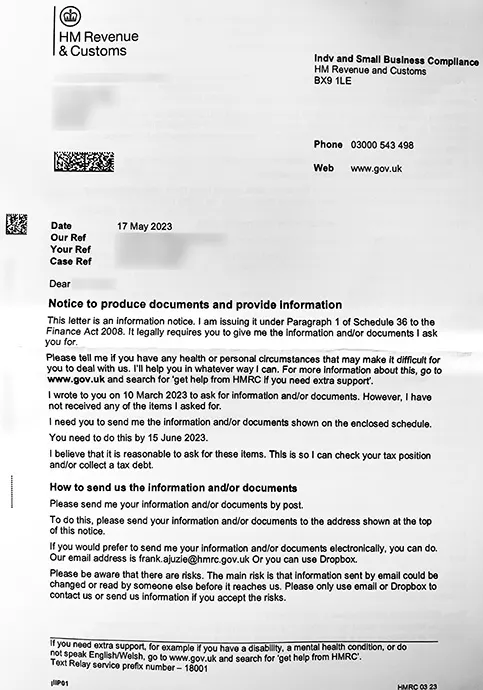

This is an information notice from HMRC, seeking to produce documents or information in order to check your tax position and if applicable, collect a tax debt.

Paragraph 1 of Schedule 36 to the Finance Act 2008 allows HMRC to require, by notice, a taxpayer to provide information or documents if those documents are reasonably required to check that taxpayer's tax position. This does not change the fact that such information notice is appealable and also, in case it is not complied in a timely manner, financial penalties could also be applied for non-compliance.

In the enclosed schedule, there is a list of documents that needs to be sent to HMRC, within 30 days.