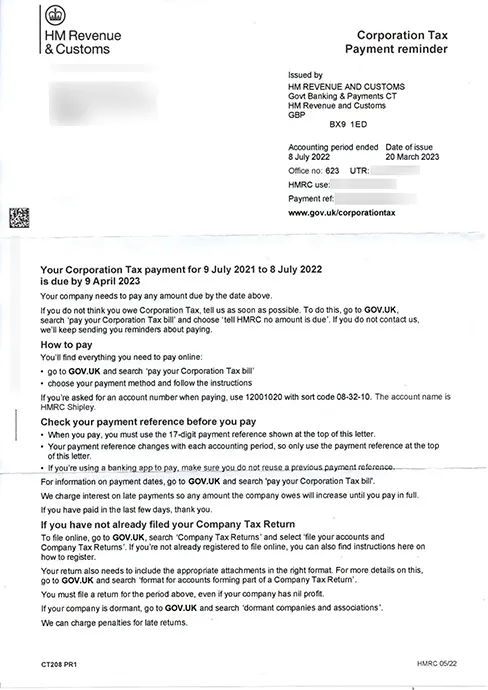

This is a reminder notice from HMRC for a corporation tax payment due to HMRC for previous bills. It is one of their constant efforts to avoid late payments altogether.

The corporation tax bill needs to be paid by you based on following deadlines -

In cases where payment is already made for corporation tax bill, you can ignore this reminder after double checking the same with HMRC over the helpline number 0300 200 3410.

Where payment has not been processed, please ensure a quick payment to avoid possible rise in interest obligations and further action from HMRC including use of debt collection agencies, removing the money directly from the bank or building society, the sale of possessions, issuing court proceedings, and as worse as closing down the business or taking it to bankruptcy.

Note: You would need a corporation tax payment reference number which is of 17 characters. This reference number changes with each accounting period.

| Account Name | HMRC Cumbernauld | HMRC Shipley |

|---|---|---|

| Sort Code | 08 32 10 | 08 32 10 |

| Account number | 12001039 | 12001020 |