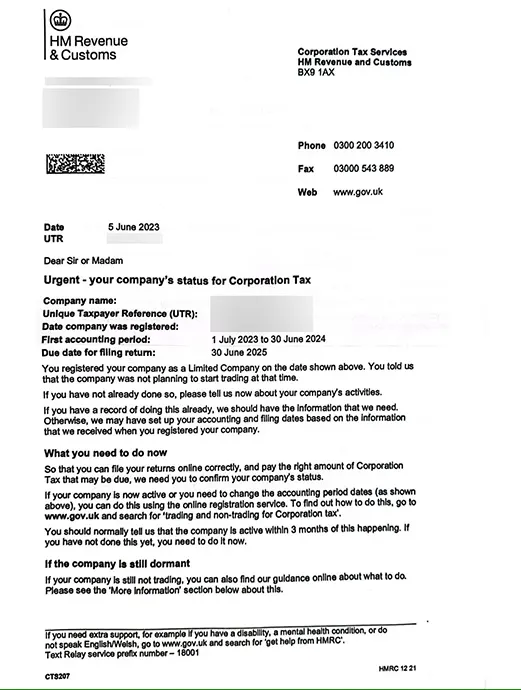

This is a reminder notice from HMRC to check upon the trading status of a dormant company in order to confirm the state of company’s activities, start filing regular accounts & compute taxes thereby, if needed.

Your company is usually dormant for Corporation Tax if it:

All dormant companies need to provide information to the HRMC regarding the trading status of the company, within 3 months of change in its status to trade.

It is mandatory for dormant companies also to file confirmation statement and annual accounts to Companies House. Also, they need to inform HMRC either by call or post about their status of dormancy to let them know that they should not expect a corporation tax return from the company, failing which they would be penalised for late filings in absence of information.