A certificate of residence is required to claim tax relief in another country if the company pays tax on its foreign income in the UK. If the company has already paid the tax it may be due a tax refund. It helps to prove residency in a particular country to another country.

A certificate of residence may be required if the company is resident in the UK and there is a double taxation agreement with the country where its trade takes place. The overseas authority dealing with the claim will require a certificate of residence and will decide if tax relief is granted. A UK tax resident certificate can help you to pay less tax abroad. Where a person is dealing in more than one country, having a certificate of UK tax residence is critically important.

You will then be entitled to treaty tax benefits. The overseas authority will decide whether relief from foreign taxes will be granted.

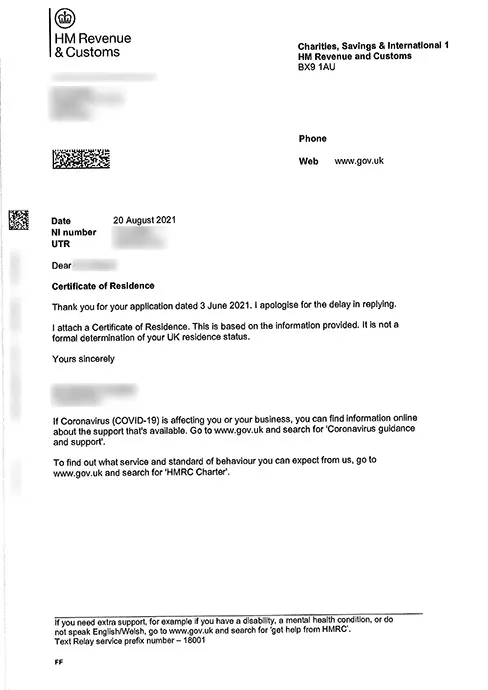

You can apply for it online. In case the other country requires it in specified form, you can send this through post to HMRC. The processing time for a tax residency certificate in the UK can vary case to case

The certificate of residence does not amount to a formal confirmation of UK residence by HMRC. HMRC will still be entitled to question the taxpayer’s residence status as part of an enquiry into his self-assessment tax return.