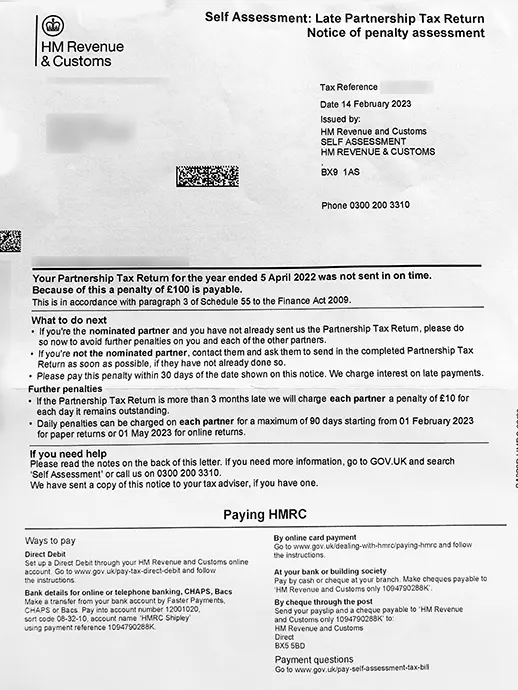

It's a notice by HMRC informing the partners of a partnership firm about the late filing penalties that have been attracted due to late-filing / non-filing of partnership tax return timely.

Partnership tax return shows the incomes received and expenses incurred on behalf of partnership firm, which is different to the individual partner's return. Each partner needs to submit his own return separately.

On failure to meet the deadline, each partner who was a member of the partnership during the return period is charged £100. If the return is more than 3 months late, each partner is charged a penalty of £10 for each additional day of delay, for a maximum of 90 days. If the return is more than 6 months late, each partner is charged a penalty of £300 and if more than 12 months late, a further £300 penalty is also attracted.

Since the return is running late, immediately file the partnership tax return to avoid any further rise in penalties to be levied on the partnership as well as partner. Also, the levied penalty needs to be paid timely to avoid any interest charges. The payment can be made by following modes