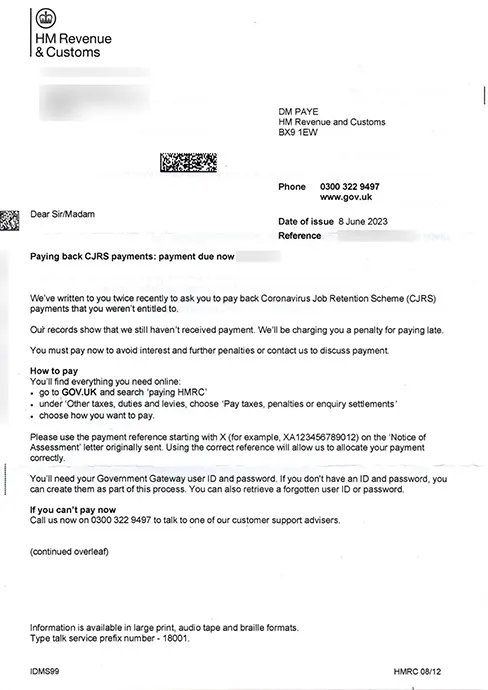

This notice informs the taxpayer to pay back Coronavirus Job Retention Scheme (CJRS) payments, which have been found by HMRC to be incorrectly claimed.

The Coronavirus Job Retention Scheme (CJRS) was a Covid-19 support measure enabling employers to retain and continue to pay staff, through providing government grants to employers. It covers a proportion of the salaries of furloughed staff.

The government had set limits and criteria for claiming these payments. For all employers who have claimed it against the rules either without being eligible for it, or claimed in excess of eligible amounts, the payments needs to be repaid to HMRC

If you’ve over claimed a grant, you must notify HMRC by latest of the following:

Else you may have to pay penalties.

Immediately repay the CJRS payments, which you were not entitled to claim, back to HMRC. This is important to be immediately actioned in order to avoid any interest charges and further penalties.