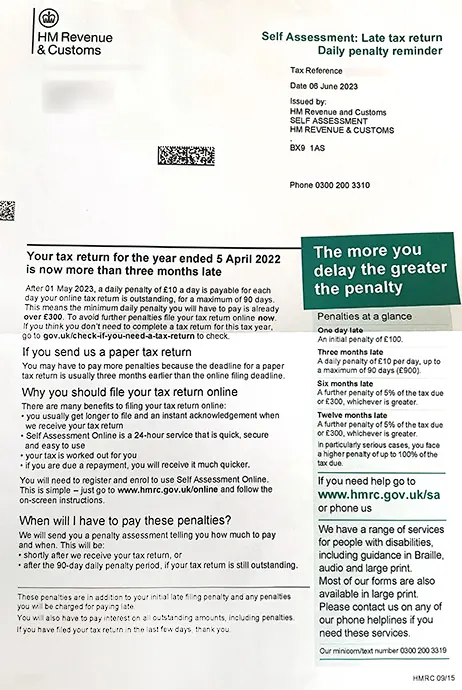

What the notice is about?

This is a reminder notice from HMRC that your self-assessment return is overdue and penalties are getting increased on daily basis now. This is generally issued after 3 months are passed since your self-assessment tax return is running overdue.

What is a self-assessment tax return?

Self-Assessment is the process by which you inform HM Revenue & Customs (HMRC) about your income, gains and relevant expenses for a tax year which HM Revenue & Customs (HMRC) uses to collect Income Tax.

What is the deadline to file this return?

Self-assessment online returns could have been filed by

- 31 January following the end of the particular tax year or

- Within 3 months after the issue of this notice,

Whichever is later. Paper tax returns need to be sent by 31 October.

What are the penalties on avoidance of filing tax returns?

- Immediate delay from deadline would attract penalty of £100;

- another £10 would be accumulated, if the delay gets more than 3 months, for a maximum of 90 days; (The reminder of this penalty rise is being highlighted in this particular letter from HMRC)

- the higher of £300 or 5% of the tax due, once delay is made more than 6 months would be added to above bill; and

- A further £300 or 5% of the tax due (whichever is higher), once delay is made more than 12 months.

What is the preferred mode to now file the return?

Since the deadline to file paper tax return is earlier than online returns, hence it is highly recommended to now file an online return now. This would help in saving some penalties.