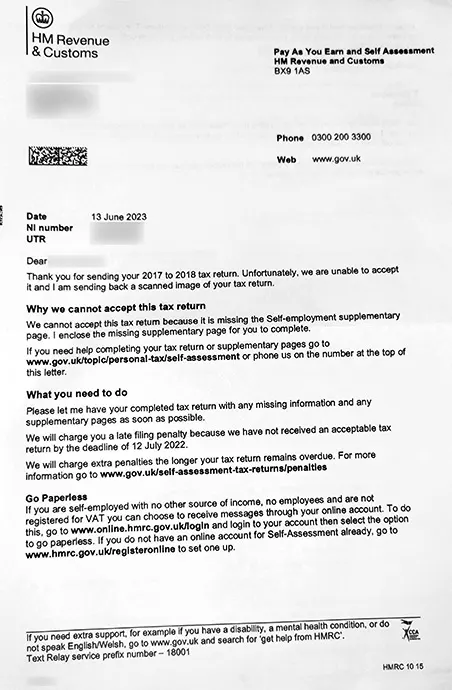

This notice is to inform you that HMRC has not accepted the return that you’ve filed with them, consisting of the reason along with a scanned copy of original return. This could be due to some prima-facie mistakes made while filing the tax return.

Return is not accepted generally due to evident errors like non-filling of mandatory information, missing or incomplete supplementary pages, incorrect tax return period and other reasons alike. The more precise reason is mentioned on this letter itself in order to enable you to correct and re-submit it.

You need to quickly re-submit the return along with all the applicable supplementary pages and avoid any further delays. This is due to the fear of increase in penalties. Also, the penalties would be attracted if an acceptable tax return is not filed to HMRC within the deadlines. Since the earlier return filed was not acceptable, it would not be able to save you from late filing penalties.