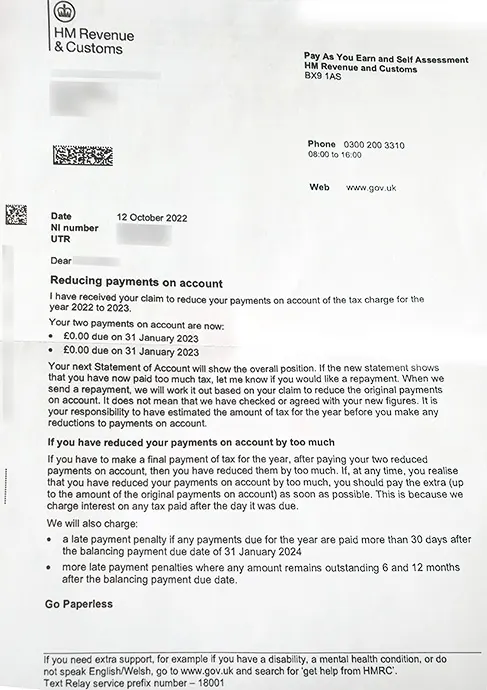

HMRC sends this notice in respect of your claim for reducing Payment on Account (PoA) of the tax charged for the year. This is to clarify the terms agreed over PoA.

Payments on account are advance payments that need to be paid towards your tax bill. You have to make 2 payments on account every year unless:

The deadlines for paying your self-assessment tax bill are usually:

If in current year your tax is going to be lower than last year then you can ask HMRC to reduce your payments on account. You can reduce your payments on account either online or by post. HMRC estimates the next tax bill to be based on last year tax bill. It could be sometimes possible that a similar income level is not expected in the next year and hence you might not have to make the same level of PoA for next year.

The terms now agreed in this letter could be used to make payments, given that, on realisation of too much reduce in PoA, the person should pay the extra tax at the earliest to avoid interest charges.