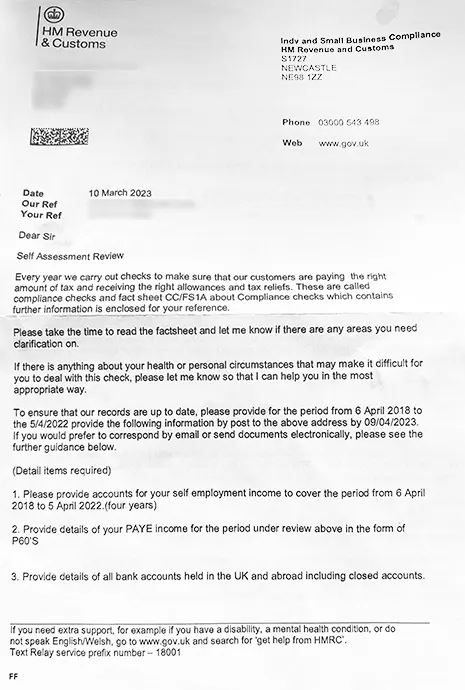

The notice is to inform the taxpayer about a compliance check being undertaken of a submitted tax return and ask for relevant documents to be submitted with HMRC within 30 days of issue of notice.

A 'compliance check', also commonly known as 'an enquiry', is a review of the accuracy of a submitted Self-Assessment tax return by HMRC. These checks can be carried out on a formal or informal basis. These are conducted each year for few individuals to ensure correctness of tax returns submitted by taxpayers.

The documents are generally mentioned in this letter itself. The main purpose is to let HMRC independently being able to calculate your tax. These might include set of accounts for self-employed individuals, P60s for employment incomes, details of bank accounts, details of property held and sold, director incomes, etc.

Yes, even your accountant or authorised agent can deal with this. Also, you can authorise somebody else too by writing to HMRC and notifying them.

Once HMRC get all documents, it will determine the accuracy of your tax return, and would let you know the results of it. This might lead you to pay some additional tax or get a repayment if you’ve paid too much tax, along with interest. Penalties could also be determined and added which are appealable.