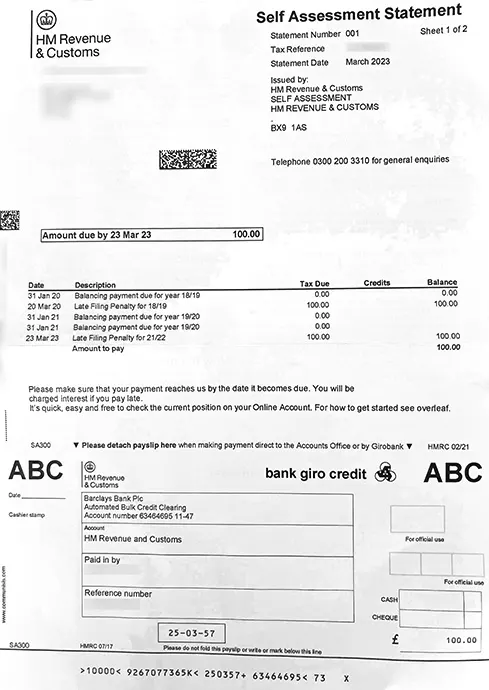

It is a copy of your account for stated dates on records with HMRC. It tells you about how much you owe, your liabilities including taxes, penalties, interests, any adjustments and past payments made towards these liabilities along with their allocation. It also shows the final amount that needs to be paid to/ received from HMRC.

HMRC charges late payment penalties as well as interest, so make sure that you pay all liabilities on time. Payments can be made through following modes

The time lags between original payment and its receipt with HMRC differs in case of different modes. Make sure the payment reaches HMRC timely.

To gain clarity about the moneys in the SA account, get in touch with HMRC to arrange a self-assessment statement been physically sent through post.

You can login to the online account of self-assessment and check for a statement history to know the past amounts added as tax liability to your account as well as payments already made towards the account. In cases where you do not have an online account, you can register for online self-assessment services at https://www.gov.uk/log-in-register-hmrc-online-services. On successful registration, they would deliver an activation code to activate your personal tax account.