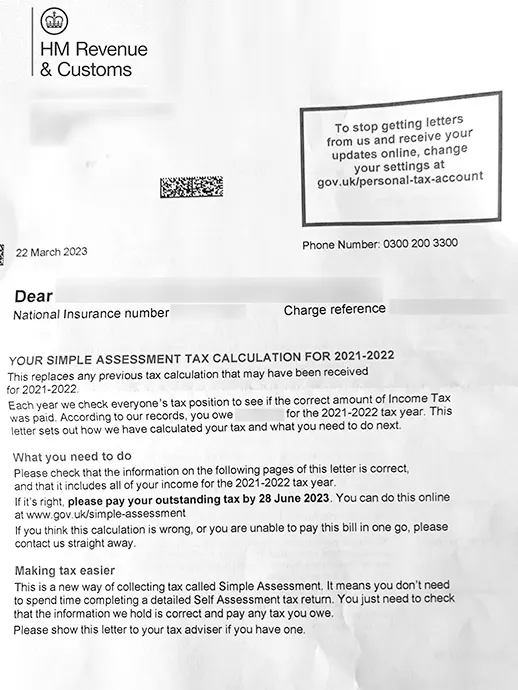

This notice contains HMRC’s calculation of your income, tax and amounts owed as a result of an assessment of your income based upon the real time information on their records.

This kind of assessment was introduced to ease the process for taxpayers, where HMRC themselves calculated tax on incomes of taxpayers, and is generally used where HMRC have already received all the required information for income determination, needed to calculate the taxpayer’s liability. This helps save time which might be spent on completing a detailed self-assessment tax return by taxpayer.

Check the figures on this calculation and agree these figures to information on your records. You might take help from HMRC agent or engage a professional tax adviser to understand these figures in more detail.

You must pay by either:

If you think the figures in your calculation are incorrect, contact HMRC to let them know the incorrect figures as well as the correct figures in place of them, within 60 days.