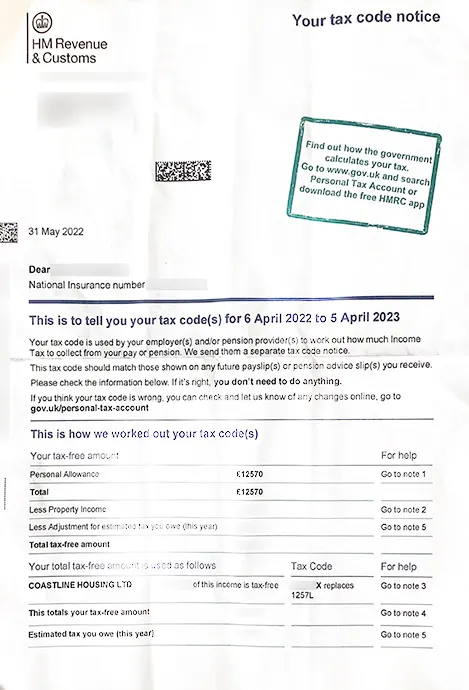

The letter contains the tax code of a person. This is generally issued when HMRC feels the need to update the tax code of a person for a particular tax year on its records as well as with employer or pension provider of the concerned person. It contains details about how this tax code has been worked out by HMRC.

A tax code is a code containing both numbers as well as letters and is used to represent the tax-free part of an employee's income, assigned by HMRC for use by employers or pension providers to determine the tax that needs to be deducted out of amounts required to be paid to him.

This is one of HMRC’s attempts to make sure that by the end of tax year, people have already paid the right amount of tax by way of PAYE tax deduction itself based on previous submitted returns. However, if you do not agree with their calculations, go to the personal tax account to view and change the information. You can also contact HMRC if you need any additional support or want to agree some arrangements with them in case of financial difficulties. If you have other taxable income that is not included in your coding notice you should inform HMRC about the same, who will amend the code accordingly.

The letter is an informative notice. Communicate with your employer to let him know about the said change. The aforementioned course of action can be taken if you do not agree with their changes. Further, in case you do not understand the calculations made by HMRC, contact your agent/ accountant to understand this in more detail.