What the notice is about?

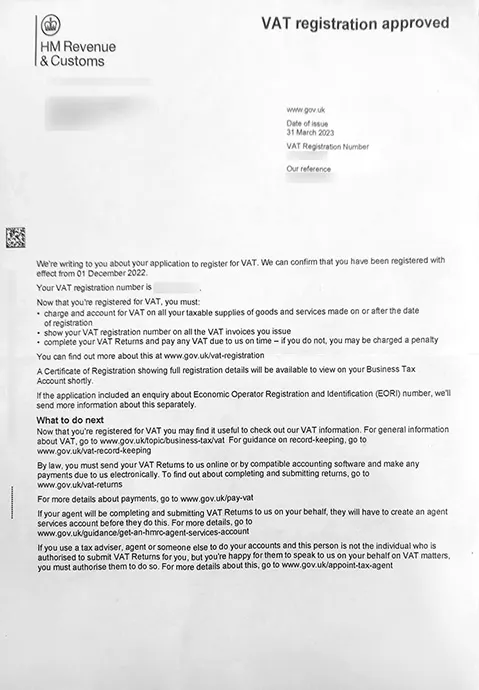

The letter is to inform you about the confirmation of your registration for VAT with HMRC. In the response to your application to register your business for VAT, HMRC issues this letter as an approval for the same.

What important details it contains?

It contains -

- VAT Registration Date - This is the date from which you have been effectively registered under VAT. On and after this date itself, the business needs to charge VAT on all taxable supplies of goods and services and is also eligible to claim input VAT on received supplies.

- VAT Registration Number - This is a nine digit number mentioned on this letter. It is a unique code that HMRC and other businesses will use to identify your business for all VAT- related purposes. It should be shown on all the invoices that you issue now onwards.

Who all required to be registered for VAT?

Businesses have to register for VAT if their VAT taxable turnover is more than £85,000. They can also voluntarily register themselves if they do not reach the above threshold.

What to do next?

As a VAT-registered business you must:

- Charge VAT on all outward supplies

- Maintain records for VAT on all input

And then

- Send a VAT return to HMRC - usually every 3 months

- Pay VAT liability to HMRC or receive refunds from HMRC.

You can also appoint an agent to deal with your VAT matters.