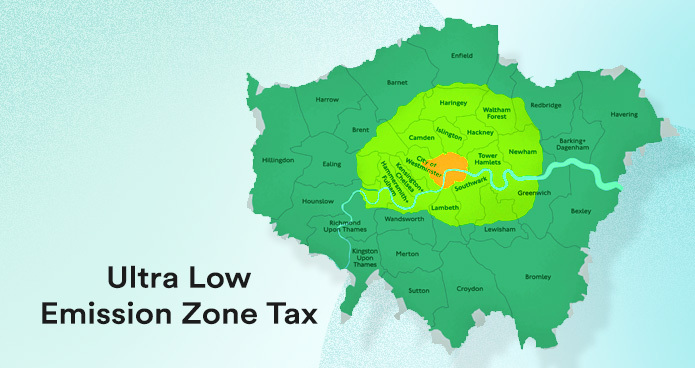

An Ultra Low Emission Zone (ULEZ) is a designated area within London which requires vehicles to meet certain emission standards or pay a daily charge. It was first introduced in April 2019 and has since been expanded to cover the whole of Greater London. The aim of the ULEZ is to reduce air pollution and improve London's air quality. Vehicles that do not meet the ULEZ standards are charged a daily fee when entering the zone.

How much is the ULEZ Zone Tax?

The amount of the ULEZ charge depends on the type of vehicle. For most cars, vans, minibuses and motorbikes it is £12.50 per day and for lorries, buses and coaches it is £100 per day. The ULEZ charge applies 24 hours a day, 7 days a week including Bank Holidays.

How to claim ULEZ Tax Refund?

The UK government has extended the deadline for self-employed individuals to claim back tax relief for ULEZ travel expenses until Tuesday, 29th March 2023. To be eligible for the tax relief, vehicle owners must have used their vehicles solely for trading purposes and travelled in any of the ULEZ areas during the period from April 2019 to March 2021.

To claim back your ULEZ tax relief, you can contact HMRC and they will be able to advise you further. You will need to provide evidence of your journey within the ULEZ area and keep all relevant receipts for tax purposes.

It is important to note that ULEZ charges are not eligible for VAT relief under any circumstances, so it is important to remember this when making a claim.

By claiming back ULEZ tax relief, you will be helping to improve air quality in London and reduce your own financial burden. It is a great way to save money while still helping the environment.

If you are considering claiming ULEZ tax relief, it’s important to be aware of the deadlines and eligibility criteria. Make sure you contact HMRC as soon as possible if you think you may be eligible.

In addition, make sure to remain up-to-date with any changes to ULEZ regulations and ensure that your vehicle meets the emissions standards required in order to save yourself from paying hefty charges when travelling within London's ULEZ area. Taking these steps will ensure that you can claim back tax relief while also helping to improve air quality in London.

By taking advantage of the ULEZ tax relief, you can save money and contribute to improving air quality in London. Be sure to contact HMRC as soon as possible if you think you may be eligible for the tax relief. And remember to stay informed about any changes to ULEZ regulations so that your vehicle meets the emissions standards required.

With the right knowledge and preparation, you can successfully claim back ULEZ tax relief while helping to improve air quality in London!

How to find out about your Local Ultra Low Emission Zone?

Knowing about your local ULEZ is key to understanding how it affects you and if you are eligible for any tax relief. You can easily check to find out if your local area is affected by the ULEZ scheme by visiting the official TFL website, which will provide you with details about the specific areas and times that are applicable for the ULEZ charges.

In addition, it is important to be aware of any changes or updates to ULEZ regulations as they can vary from time to time. You can do this by signing up to the official TFL email list which will send you notifications about any updates or changes to ULEZ regulations.

What evidence do I need to provide to Claim Back my ULEZ Tax Refund?

To claim back your ULEZ tax refund, you will need to provide evidence of your journey within the ULEZ area. This includes receipts for any travel expenses you have incurred while travelling in the ULEZ areas and records of the dates and times that your vehicle travelled within the zones.

It is important to keep all relevant documents for tax purposes and make sure they are up-to-date with all the latest changes to ULEZ regulations so that you can accurately claim back any tax relief available for your journeys.

By providing evidence of your journey within the ULEZ area, you will be ensuring that you can successfully claim back any ULEZ tax relief that is applicable to you. Make sure to stay informed about any changes to ULEZ regulations and keep all relevant documents for tax purposes so that you can accurately claim back any applicable tax relief.

Follow these steps and you will be able to successfully claim back your ULEZ tax refund while also helping to improve air quality in London!

What Vehicles are Exempt from ULEZ?

There are certain vehicles that are exempt from ULEZ charges. These include classic cars, motorbikes, agricultural vehicles and emergency services vehicles. It is important to check whether your vehicle meets the criteria for exemption before travelling within a ULEZ area so that you can avoid paying any unnecessary charges.

You can also apply for a temporary or permanent ULEZ vehicle exemption if your vehicle does not meet the emissions standards required. Make sure to check the TFL website for further information about qualifying vehicles and how to apply for an exemption.

By taking these steps, you can make sure that you are not paying any unnecessary charges when travelling within London's ULEZ area. It is also important to remember that ULEZ charges are not eligible for VAT relief under any circumstances, so make sure to keep this in mind when making a claim.

Following these steps will ensure that you can save money while still helping to improve air quality in London. So take advantage of the exemption criteria and apply for an exemption if necessary - it could save you time and money!

Is There VAT on ULEZ Charge?

Yes, the Ultra Low Emission Zone (ULEZ) charge in London is subject to Value Added Tax (VAT). When paying the ULEZ charge, the amount you see includes VAT at the standard rate. This means that part of your payment goes towards the tax. The ULEZ charge aims to reduce pollution by encouraging drivers to use less polluting vehicles, and this environmental initiative does not exempt it from VAT.

Conclusion

In conclusion, understanding ULEZ regulations is key to being able to claim back any tax relief that you may be eligible for. Make sure you know your local ULEZ scheme and how it affects you, as well as staying informed about any new developments or changes in the scheme that may occur. By taking these steps, you can save yourself time and money while helping to improve air quality in London.

Good luck with claiming your ULEZ tax relief!