Running payroll for your business doesn't have to be complicated, but understanding the basics is essential for keeping everything organised. One question many employers ask is: "What exactly is a payroll number, and do I need one?"

A payroll number is a unique identifier assigned to each employee within your payroll system, helping you track payments, deductions, and employee records accurately. While not legally required, payroll numbers are increasingly important for

- Data protection,

- Efficient record-keeping, and

- Preventing costly payroll errors.

This guide will explain everything you need to know about payroll numbers, from how to create them to where employees can find them on their payslips.

What Is a Payroll Number?

A payroll number is a unique combination of letters and numbers assigned to each employee within your company’s payroll system. Think of it as a personal reference code that distinguishes employees from one another, especially useful for managing large teams or staff members with similar names.

- This identifier plays a vital role in;

- Streamlining payroll processes,

- Simplifying wage calculations,

- Tracking employment history, and

- Ensuring accurate records for HMRC reporting.

Payroll numbers are typically displayed on payslips alongside other employee details and can be formatted in various ways to suit your business requirements.

How Do I Know My Payroll Number?

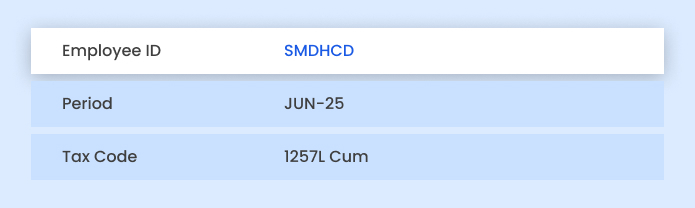

If you're trying to locate your payroll number, the simplest way is to check your payslip. In the UK, payroll numbers are typically displayed prominently, often near the top of the document alongside your name and other personal details.

Here are the most common places to locate your payroll number:

- On your payslip: Look at the header section, often labelled as "Employee ID.", "Payroll ID", or "Staff Number"

- Through your HR department: Contact your human resources team directly for this information

- Online employee portals: Many companies provide digital access to payroll information through secure websites

- Employment documentation: Some businesses include payroll numbers on contracts or employee handbooks

If you can't find your payroll number on any of these documents, speak with your employer's payroll or HR department for assistance.

What's the Difference Between a Payroll Number and a PAYE Reference Number?

It is essential for both employers and employees to understand the difference between these two numbers, as each plays a distinct role in the UK tax system.

Payroll Number: This is a unique employer-assigned ID used to track employee records within the payroll system, formatted according to the employer’s specifications.

PAYE Reference Number: Issued by HMRC, this three-digit tax office code combined with a unique reference number (e.g., 123/AB12345) serves to identify your employer for tax purposes. It is used to submit tax and National Insurance information, ensuring accurate and efficient processing.

The main distinction lies in their purpose: payroll numbers are internal identifiers specific to your company, while PAYE reference numbers serve as external identifiers used for government reporting and tax collection. Take a look at how a PAYE reference number looks like here.

Is a Payroll Number the Same as a National Insurance Number?

No, a payroll number and a National Insurance number are entirely different, and it's essential not to confuse them.

- Your National Insurance number is a unique, government-issued identifier that stays with you for life. It doesn’t change, no matter how many jobs you have or who your employer is. This number is used to track your National Insurance contributions and other government-related records throughout your career.

- In contrast, a payroll number is assigned by your employer and is specific to your time with that company. If you leave a job and return later, you’ll typically be given a new payroll number, as it pertains solely to your employment period with that particular employer, not to you as an individual.

How Payroll Numbers Protect Employee Data

Payroll numbers are essential for safeguarding sensitive employee information and ensuring GDPR compliance. By replacing names and personal details with numerical identifiers in payroll systems, businesses can greatly minimize the risk of data breaches while enhancing data security.

Here's how payroll numbers enhance data protection:

Minimise Personal Data Exposure:

Replace full names or other identifiable details with payroll numbers during routine payroll processing to safeguard employee identities.

Reduce Risks of Misdelivery:

Unique payroll identifiers ensure payslips and salary details are delivered to the right employees, which is especially critical when multiple staff members have similar names.

Enhance Audit Trails:

Payroll numbers establish a clear and traceable system, helping businesses maintain compliance with data protection regulations.

Ensure Secure Data Storage:

Personal information can be stored separately from day-to-day payroll activities, with payroll numbers serving as a secure link between systems.

Streamline Confidential Reporting:

When reporting to HMRC or other authorities, payroll numbers offer a secure way to reference employees without revealing unnecessary personal information.

How Debitam Can Help You Manage Payroll Numbers Effectively

Managing payroll numbers and ensuring compliance with UK regulations can be complex, especially as your business grows. Professional payroll services can streamline this process while ensuring accuracy and compliance.

Debitam provides robust payroll solutions that simplify and streamline the management of unique payroll numbers for your employees. Our system ensures every identifier is flawlessly unique, properly formatted, and fully compliant with HMRC reporting standards.

What our payroll services offer:

- Automated payroll number generation to eliminate duplicates and maintain consistency across your records.

- Secure data management to safeguard employee information while ensuring easy access for authorized personnel.

- Seamless HMRC compliance with accurate payroll identifiers for all reporting requirements.

- Digital payslips displaying payroll numbers alongside all essential payment details.

- Expert support to guide you through best practices for payroll number management and implementation.

- Auto enrolment to pension schemes ensures that employees are systematically included in workplace pension plans, meeting legal obligations with minimal administrative burden.

- Customisable payroll solutions tailored to fit the unique needs of your business, supporting scalability and flexibility as your organization grows.

- Integration with accounting software to streamline financial management and reduce the risk of manual errors.

- Compliance monitoring and updates to keep your payroll processes aligned with the latest regulations and industry standards.

- Comprehensive reporting tools to provide valuable insights into payroll trends, enabling informed decision-making and resource allocation.

Whether you're establishing payroll for the first time or refining your current system, our expert guidance ensures a seamless, scalable solution. We help your payroll process evolve effortlessly, keeping pace with your business growth.